about Michigan

The American Jobs Project was borne of two tough problems: loss of middle-class jobs in America and congressional paralysis. It seeks to address these problems by taking advantage of one of the biggest market opportunities of our era—the advanced energy sector—and to do so at the state, not the federal level. Policymakers who leverage the unique strategic advantages of their state to grow localized sectors of interconnected companies and institutions are poised to create quality jobs.

Michigan is well-positioned to benefit from the growing demand for advanced energy given the state’s strength in advanced manufacturing and engineering, leading universities and research facilities, and skilled labor force. With investments totaling $2.9 billion, Michigan brought approximately 1,450 MW of new advanced energy projects online between 2008 and 2014. Opportunities to leverage this momentum to further serve growing regional, national, and global markets offer real benefits for Michigan’s economy and good-paying jobs for the state’s residents.

Extensive research and more than forty interviews with local stakeholders and experts in Michigan have resulted in identifying two economic sectors showing particular promise: smart buildings and solar.

There are several barriers hindering Michigan’s advanced energy industries and preventing supply chains from reaching their full potential. Michigan must address these roadblocks to grow the state’s advanced energy sectors and realize economic gains. In order to take full advantage of these opportunities, Michigan’s policymakers can enact policies to increase demand for smart buildings and solar technology and to help the state’s businesses grow, innovate, and outcompete regional, national, and global competitors. Indeed, with the right policies, Michigan can create as many as 180,000 job-years through 2030. That is nearly 12,000 jobs per year.

This project serves as a research-based roadmap for state and local leaders who seek to develop smart policies focused on leveraging Michigan’s resources to create skilled, good-paying jobs.

Summary of Recommendations

The analysis presented in this report culminates in four thematic sets of recommendations for Michigan’s policymakers. Each set of recommendations identifies opportunities for barrier removal and future growth in the advanced energy sector. Taken together, these recommendations chart a course for Michigan leaders to create and enhance jobs in the advanced energy sector.

Smart Building and Energy Efficiency

Allow On-Bill Financing for Energy Efficiency Improvements: Financing home energy improvements can be challenging because energy efficiency investments often involve high upfront capital investments. On-bill financing addresses this issue by allowing utilities (or financial institutions) to provide the upfront capital to finance energy efficiency improvements through a loan that is repaid on the customer’s monthly utility bill. Michigan passed legislation in December 2014 that allows municipal utilities to offer on-bill financing programs to their customers. The Legislature could continue expanding access to this critical tool by repealing the on-bill financing ban for IOUs, which serve nearly 90 percent of electricity customers in Michigan.

Expand Dynamic Pricing to Promote Demand Response: Demand response is a pricing structure that allows utilities and grid operators to reduce costs by creating incentives for customers to adjust their demand for electricity in response to system conditions. Properly managed demand response can reduce the long-term cost of managing an electric grid by reducing the need to build expensive “peaking” power plants, and instead paying a lower cost for end-user demand reductions during peak hours. Michigan can capture the benefits of demand response by expanding dynamic pricing in two ways: (1) The Michigan Public Service Commission (MPSC) could make dynamic pricing the default electricity rate structure for all commercial and industrial customers in the state, expanding beyond existing pilot programs; and (2) residential customers could be allowed to opt into dynamic rates.

Allow for Decoupling of Electric Utility Revenues: Due to the way utility rates are normally set, regulated utilities have a strong incentive to increase sales, discouraging them from promoting investments in energy efficiency improvements. Many states now allow utilities to receive a certain amount of revenue, regardless of the level of sales. This is called “decoupling.” Michigan can capitalize on the benefits of this type of regulatory structure by granting the MPSC the authority to implement decoupling for electric utilities.

Integrate Demand Reduction into the Capacity Planning Process: Building new power plants is not the only way to meet a grid’s capacity needs; permanent and “dispatchable” forms of demand reduction can also contribute to electricity capacity to markets. For example, a supermarket may be able to automatically dim its lights in response to a “dispatch” signal from the grid operator. Similarly, a factory could permanently reduce its demand during peak hours through a project to eliminate energy waste in its HVAC system. Michigan policymakers could require utilities to investigate low-cost demand reduction alternatives before authorizing new generation to be built under centralized planning processes. Alternatively, if Michigan moves towards a market-based approach for capacity planning, the MPSC could ensure that demand reduction proposals have the ability to bid directly into wholesale markets.

Remove the Spending Limits for Energy Waste Reduction Programs: Michigan utilities have exceeded target savings levels set by 2008 legislation (PA 295) aimed at driving smart investments in energy waste reduction. Current spending caps on utility waste reduction programs limit further increases in cost-effective savings. Given the long-term financial benefits of energy waste reduction investments, Michigan policymakers could eliminate these spending caps. Instead of a cap, the MPSC could require utilities to show an expected minimum return on investment for Michigan consumers on every dollar invested in energy waste reduction efforts.

Solar

Streamline Solar Permitting: Costly and inconsistent permitting processes currently burden solar expansion in Michigan. In fact, estimates suggest that up to 50 percent of the cost of a solar installation can be attributed to the time and money devoted to navigating the permitting process. The high cost of permitting contributes to Michigan having the tenth highest solar installation cost in the country. While proper permitting is both important and necessary, a confusing and burdensome web of permitting requirements that vary across the state is an unnecessary drag on Michigan’s economic growth. Michigan could draw on recent successes in Colorado and Vermont where leaders have cut red tape and streamlined the solar permitting process across the entire state.

Remove Restrictions on Solar Net Metering: Michigan ranks in the bottom half of all states with respect to per capita solar capacity. One of the factors contributing to Michigan’s low level of solar adoption is the way it has designed its net metering policy. Unfortunately, Michigan imposes individual and system-wide restrictions on solar projects to qualify for net metering. Michigan could alleviate these restrictions and increase the adoption of solar in the state by (1) raising the cap on individual solar projects to encourage larger distributed projects, and (2) raising the system-wide cap to send a signal to solar developers that the state is open for business.

Allow Local Communities to Access Solar Power: A straight-forward way for Michigan leaders to support the state’s emerging solar sector is to ensure that all consumers who wish to purchase renewable power have access to it. Currently, an estimated 49 percent of homes and 48 percent of businesses in the United States are locked out of the solar market due to the cost of financing a photovoltaic (PV) project, a lack of property rights (for renters), or because their land or buildings are not well suited for solar. Community choice aggregation allows more local control for delivering solar power to customers who wish to purchase it.

Ease Taxes on Solar Projects: Solar installation tax assessments can have significant consequences on the economics of solar deployment within a state. Rulings by the Michigan State Tax Commission and Michigan Department of Treasury have effectively nullified intended legislative tax exemptions for commercial and industrial solar projects. Additionally, the state does not offer a tax exemption policy for residential solar. Michigan policymakers have the potential to grow the state’s solar capacity by addressing related tax issues: (1) the legislature could extend tax exemptions to residential solar projects, putting them on an equal footing with commercial and industrial projects; and (2) the commercial and industrial tax exemption measure could be clarified to ensure that the Michigan State Tax Commission and Department of Treasury understand its intent.

Combine Solar and Electric Vehicle Charging Infrastructure: The transportation electrification process is underway. Under a scenario where vehicle fleets shift from dependence on gasoline and other liquid fuels to electric drivetrains, demand for electricity will rise. Meeting a portion of this increased demand by combining solar with electric vehicle charging infrastructure provides distinct benefits for Michigan.

Innovation Ecosystem and Access to Capital

Facilitate Partnerships within the Energy Innovation Ecosystem: Alignment between Michigan’s leading research universities, private companies, nonprofits, and government can accelerate innovation and growth to stimulate a private market for energy innovation that will create jobs for Michiganders. The state could build on existing coordination efforts by allocating funding to jumpstart an energy innovation network.

Create a Technology Investment Tax Credit: Investments in early-stage technology start-ups are essential for states to stay competitive and spur job creation. One policy that has seen success in multiple states is a Technology Investment Tax Credit. Michigan policymakers could offer this tax credit to grow the emerging hub of start-ups in Ann Arbor and Detroit, create a magnet for business investment, and boost economic activity.

Workforce Development

Capitalize on Digital Manufacturing to Drive Job Creation: Michigan leaders could build on existing strengths by facilitating public-private partnerships that increase the competitiveness and innovation capacity of small- and medium-sized manufacturers, promote advanced manufacturing technology, and develop corresponding workforce training. Without assistance, many companies cannot afford to invest in new technologies and the necessary workforce training, putting them at risk of losing out on major business opportunities.

Invest in and Retain Michigan Science, Technology, Engineering, and Math (STEM) Talent: Michigan ranks last in the country in retention of young people, ages 25-34. STEM-educated students from Michigan’s four-year universities could be given financial incentives to remain in-state after graduation through tax breaks.

Help Dislocated Veterans Transition to the Advanced Energy Sector: Many veterans have skills that can be retooled for advanced energy industries, making them an important population to consider in workforce development efforts. Michigan could establish a program for retooling veterans’ skills for jobs in high-tech sectors, such as STEM and advanced energy industries.

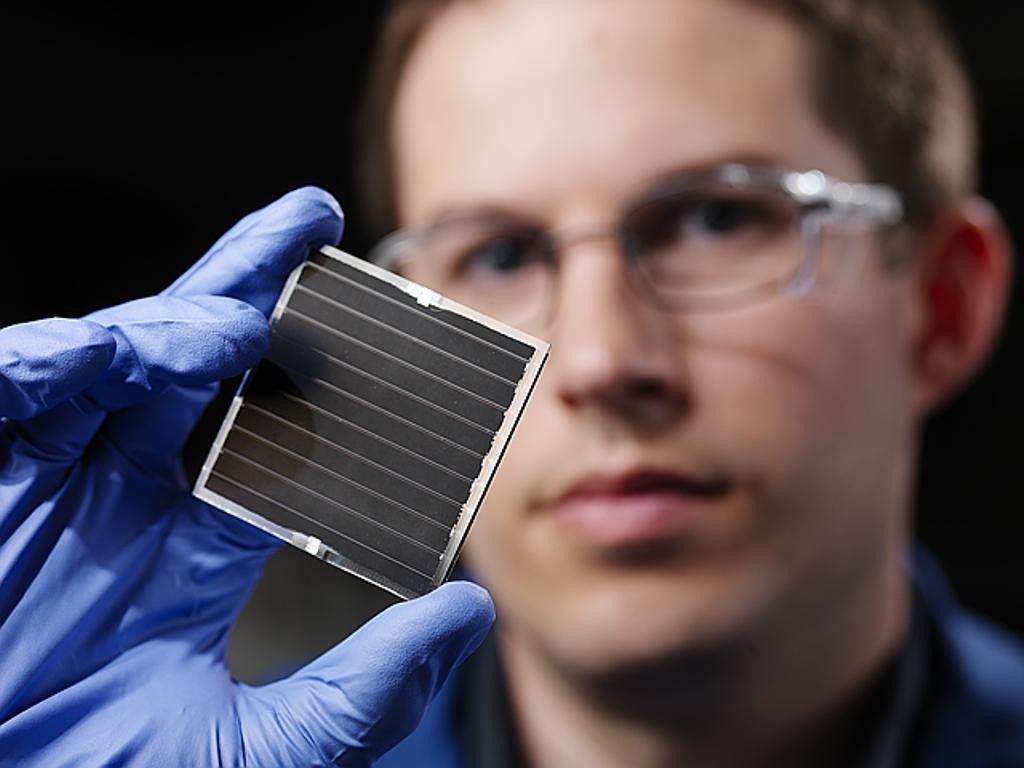

[caption id="attachment_401" align="aligncenter" width="622"] Solar Cell

Solar CellPhoto Credit. Pacific Northwest National Laboratory - PNNL via Foter.com / CC BY-NC-SA[/caption] [caption id="attachment_402" align="aligncenter" width="623"]

Smarthome Automation Control

Smarthome Automation ControlPhoto Credit. Samsung Newsroom via Foter.com / CC BY-NC-SA[/caption]