A cluster’s success is dependent on its access to capital, or its ability to attract entrepreneurs and connect investors with market opportunities. Many of the technologies that will be central to the new energy economy are initially capital intensive, with minimal future operational costs. New and growing businesses will face severe financial hurdles during technology development, commercialization, and expansion. Having access to investors and non-dilutive capital, such as grants and loans, can be the difference between success and failure.

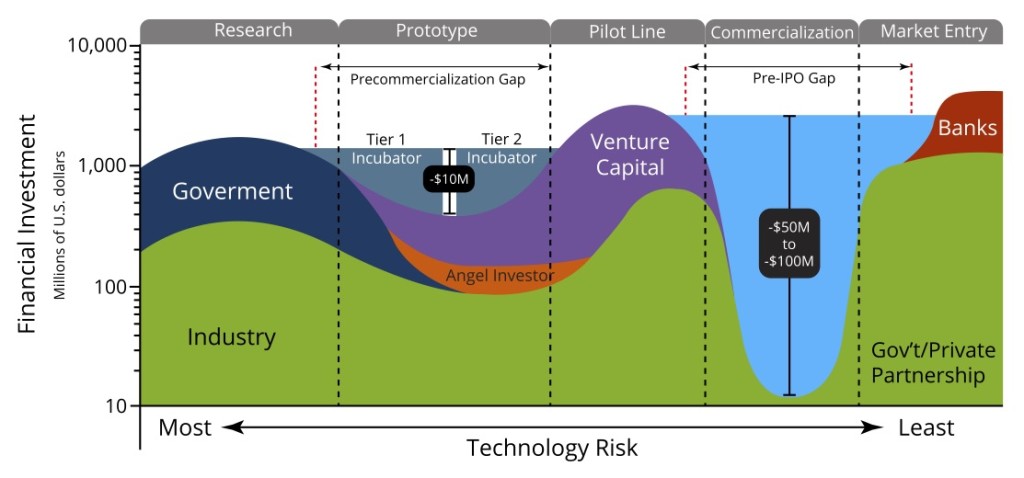

Companies nationwide face funding shortages during the prototyping and commercialization phases, commonly known as the “valleys of death.” In 2014, 75 percent of venture capital funding went to companies in California, New York, and Massachusetts; businesses in the other forty-seven states had to compete over the remaining 25 percent, stifling innovation across the country and highlighting the importance of state policies for new venture capital investments. Stretched state and federal budgets shrink the availability of government dollars, impeding mass development and deployment of new clean energy technologies. Moreover, high interest rates are associated with capital for emerging technologies, which are unfamiliar and high-risk to investors.

In order to maximize the success of advanced energy businesses that create good-paying jobs, states should consider actively facilitating access to capital. Methods for the public sector to increase access to capital include developing policies to lower financial risk, engaging venture capitalists, and creating public or privately managed fund of funds to invest in targeted technologies. Programs like online equity crowdfunding platforms can be innovative, low-cost mechanisms for states to attract private funding for new companies.

Explore best practice strategies that increase and streamline access to capital in our policy bank.